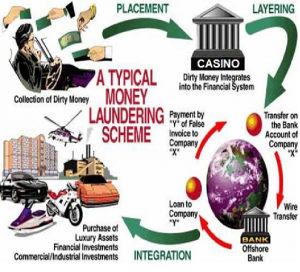

According to Grant Eve, partner at Joseph Eve, there are 3 stages of money laundering:

- Placement

- Layering

- Integration

The “placement” of the funds into a financial institution is the first stage of the money laundering process and this is the stage where casinos are most vulnerable. A comprehensive title 31 compliance program is vital in order to prevent “placement”. FinCEN is authorized to assess civil penalties against casinos and employees thereof for willful violations of the anti-money laundering program, reporting, and record keeping requirements.

Components of a successful title 31 compliance program that can prevent non-compliance, include but not limited to:

- Written system of internal controls

- Internal and/or external testing for compliance

- Training of casino personnel

- BSA compliance officer

- Use of title 31 compliance software to aid in assuring compliance

For a detailed presentation on title 31 compliance & recent developments and help with your title 31 compliance program, see Grant Eve’s presentation from NIGA 2012: